Secure Your Future With Relied On Lending Services for a Better Tomorrow

In a globe where monetary stability is a keystone of a protected future, transforming to relied on financing services can be a calculated step towards making certain a brighter tomorrow. The course to economic empowerment begins with understanding the value of choosing the ideal financing solutions, establishing the stage for a thriving future built on a structure of trust fund and integrity.

Value of Trusted Finance Solutions

Dependably trusted car loan services play a critical function in allowing companies and people to safeguard financial support with self-confidence and tranquility of mind. When seeking financial backing, the reputation and dependability of the financing provider are vital. Relied on funding services supply transparency in their problems and terms, guaranteeing that consumers completely understand the effects of the funding agreement. This openness develops trust in between the loan provider and the customer, fostering a sustainable and positive financial relationship.

Additionally, relied on loan services typically give affordable rates of interest and flexible payment choices tailored to the person's or business's financial scenario. This modification enhances the debtor's capacity to handle their funds effectively and repay the loan without undue tension.

Furthermore, credible financing solutions focus on client fulfillment and support, providing assistance and support throughout the financing application procedure and past. This level of client service infuses self-confidence in customers, understanding that they have a dependable partner to transform to in times of demand - bc loans. Overall, the importance of relied on finance services can not be overstated, as they offer as pillars of financial security and development for individuals and companies alike

Kinds Of Fundings Available

Relied on car loan services that prioritize openness and consumer satisfaction offer a variety of car loan options tailored to fulfill the varied economic demands of people and services. Personal car loans are a common type that individuals can access for numerous functions such as financial debt combination, home enhancements, or unexpected expenses. These car loans typically have dealt with rates of interest and established repayment terms.

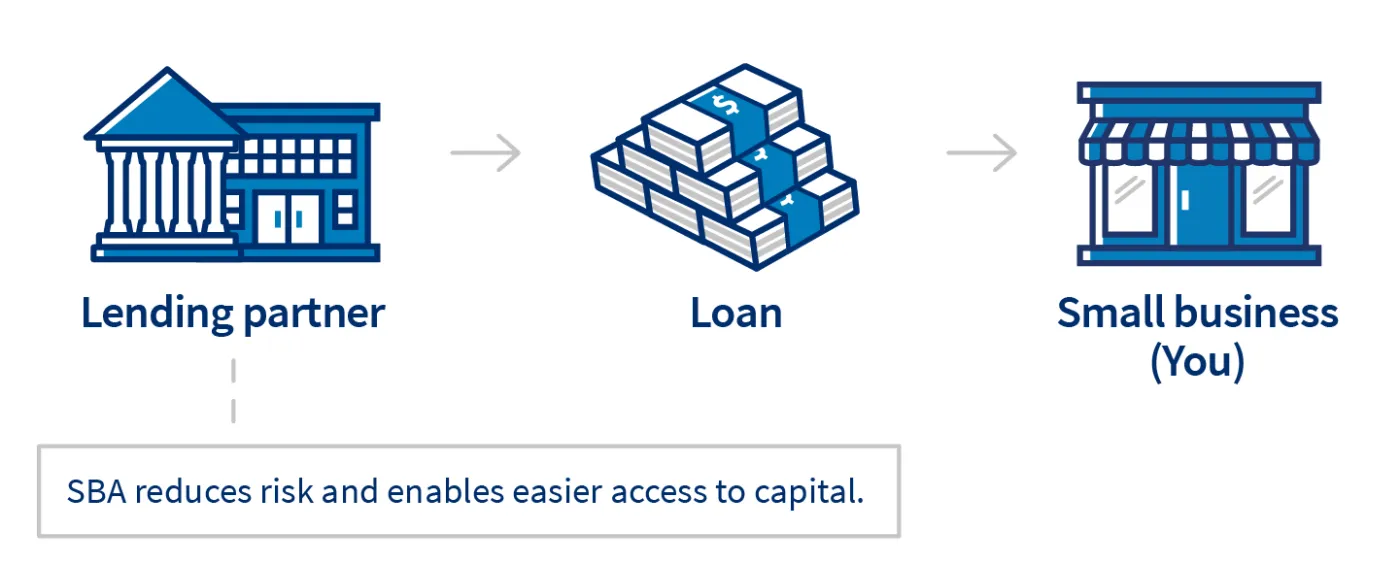

For those wanting to acquire a home, mortgage are readily available, giving lasting funding with either dealt with or flexible rates of interest. Organization car loans accommodate business owners looking for resources to begin or increase their ventures. These fundings can vary in regards to repayment timetables and rate of interest based upon the lending institution and the organization's financial standing.

Additionally, vehicle fundings are designed especially for buying lorries, offering competitive prices and adaptable terms. Pupil car loans help pupils cover instructional costs, with options for both exclusive and government car loans. Comprehending the types of fundings readily available is crucial for making informed financial decisions and safeguarding a brighter future.

Benefits of Dealing With Trusted Lenders

Working together with recognized banks uses customers a variety of advantages that can enhance their general lending experience and monetary well-being. bc loans. One vital benefit of functioning with respectable lending institutions is the assurance of transparency and moral methods. Developed banks are regulated and abide by stringent market requirements, offering debtors with clear conditions, making sure there are no concealed costs or shocks throughout the financing process

Moreover, credible lending institutions usually provide affordable rate of interest and desirable financing terms, making it possible for customers to accessibility funds at even more budget friendly rates contrasted to different loaning alternatives. This can lead to considerable cost financial savings over the life of the loan, making it less complicated for customers to manage their financial resources effectively.

Furthermore, collaborating with relied on lending institutions can likewise enhance the customer's credit history and monetary reputation. Timely settlements and responsible loaning actions with trustworthy organizations can favorably affect the debtor's credit rating, opening up chances for far better loan terms in the future. Overall, the benefits of working together with reputable lenders extend beyond the instant loan deal, establishing a solid foundation for a safe and secure monetary future.

Just How to Get a Lending

To protect a loan from trusted lending institutions, borrowers should browse around these guys fulfill details eligibility standards based on their monetary background and credit reliability. Lenders commonly examine a person's credit report, earnings stability, work standing, debt-to-income proportion, and total financial health and wellness when thinking about a loan application. A great credit rating, generally above 650, demonstrates a history of liable loaning and enhances the possibility of funding approval. Stable work and a constant revenue show the debtor's capability to repay the lending on schedule. Lenders also evaluate the debt-to-income proportion to make sure that the debtor can handle additional debt sensibly. Additionally, a favorable settlement background on existing finances and credit score accounts can enhance the customer's credit reliability. Supplying updated and accurate financial information, such as bank statements, income tax return, and pay stubs, is important during the funding application procedure. By meeting these eligibility needs, debtors can improve their chances of getting approved for a financing from relied on lending institutions and securing a brighter financial future.

Tips for Accountable Borrowing

An additional suggestion for accountable borrowing is to research study and compare loan choices from various loan providers. Try to find respectable organizations that supply positive terms, low-interest prices, and flexible repayment schedules. Comprehending the terms and problems of the lending agreement is essential to stay clear of any type of surprises or hidden costs down the line.

In addition, always checked out the small print before signing any kind of documents. bc loan. Make sure you know all the responsibilities, charges, and costs associated with the lending. By being notified and positive, you can make obtaining a favorable financial decision for a brighter tomorrow

Final Thought

Finally, safeguarding a lending from trusted loan providers is necessary for a brighter monetary check that future. By recognizing the kinds of loans available, the benefits of dealing with respectable lenders, and read here exactly how to get approved for a funding, people can make educated decisions for their monetary wellness. It is essential to obtain responsibly and consider the long-lasting implications of obtaining a car loan to guarantee monetary stability in the future.

Relied on loan services provide openness in their problems and terms, making sure that debtors completely understand the implications of the lending agreement.In addition, respectable loan services focus on customer complete satisfaction and assistance, supplying advice and support throughout the funding application procedure and beyond.Relied on financing solutions that focus on openness and client satisfaction use a range of funding choices tailored to satisfy the varied monetary requirements of businesses and individuals. Pupil loans assist students cover instructional costs, with alternatives for both exclusive and federal loans. By comprehending the types of loans readily available, the benefits of functioning with credible loan providers, and how to certify for a loan, individuals can make enlightened decisions for their economic wellness.

:max_bytes(150000):strip_icc()/Term-Definitions_loan.asp-b51fa1e26728403dbe6bddb3ff14ea71.jpg)